I invested in Savings Bonds in 1996 and 1997. When do they reach maturity?

Treasury Resumes Sales of State and Local Government Series Securities RFI on the U. S. Treasury Market Structure Watch our TreasuryDirect demo on logging in.

Replace lost and unredeemed U.S. Savings Bonds. Trace missing bonds in an unclaimed safe deposit box. Reissue stolen or destroyed bonds. Cash in Postal Savings Bonds …

Singapore savings bonds, the government’s way of beating the banks and coming up with their version of the ‘fixed deposit accounts’ for individuals.

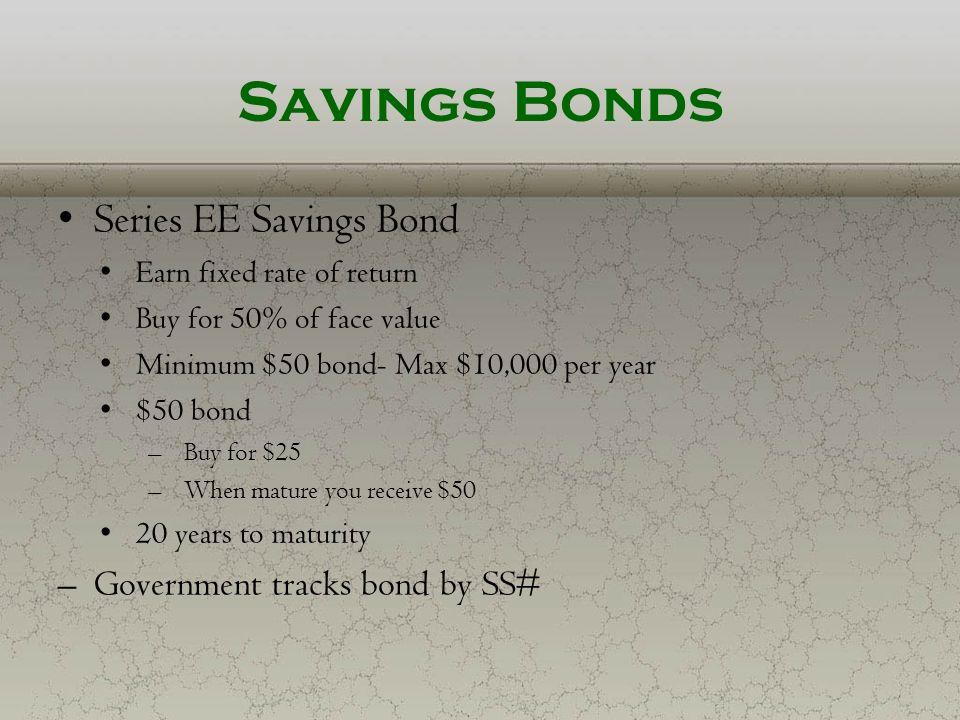

What are ‘U.S. Savings Bonds’ A U.S. savings bond is a government bond that offers a fixed rate of interest over a fixed period of time. Many people find these bonds attractive because they are not subject to state or local income taxes. These bonds cannot easily be transferred and are non

Electronic Bonds 101 Paper Bonds (Series I only) A Great Investment for Everyone. U.S. Savings Bonds offer a safe, easy way to save money …

:fill(transparent,1)/about/TheWayYouTitleYourUnitedStatesSavingsBondsCanHaveTaxConsequences-56ae67705f9b58b7d010097f.jpg)

Expert answers to your questions about how, when, and where to redeem cash in or redeeming or cashing in series E, EE, H, or HH US Savings Bonds redemption.

Compare 1200 Saving Bonds from leading UK Saving Bond Providers. Find a good rate then simply apply online for your savings Bond.

This means you can delay claiming the interest income until you redeem the bonds (or until they mature, which is typically 30 years after issue). If you don’t want to claim income now, but you wouldn’t mind claiming it later, savings bonds can help.

Series I Savings Bonds (often called I Bonds) are government savings bonds issued by the U.S. Treasury that offer inflation protection. I Bonds offer tax-deferral for up to 30 years and are free from state and local taxation. I Bonds are not marketable securities and cannot be traded in the